My StockX Data Competition Submission and Findings

Created with Excel, PowerPoint, and Tableau

Background

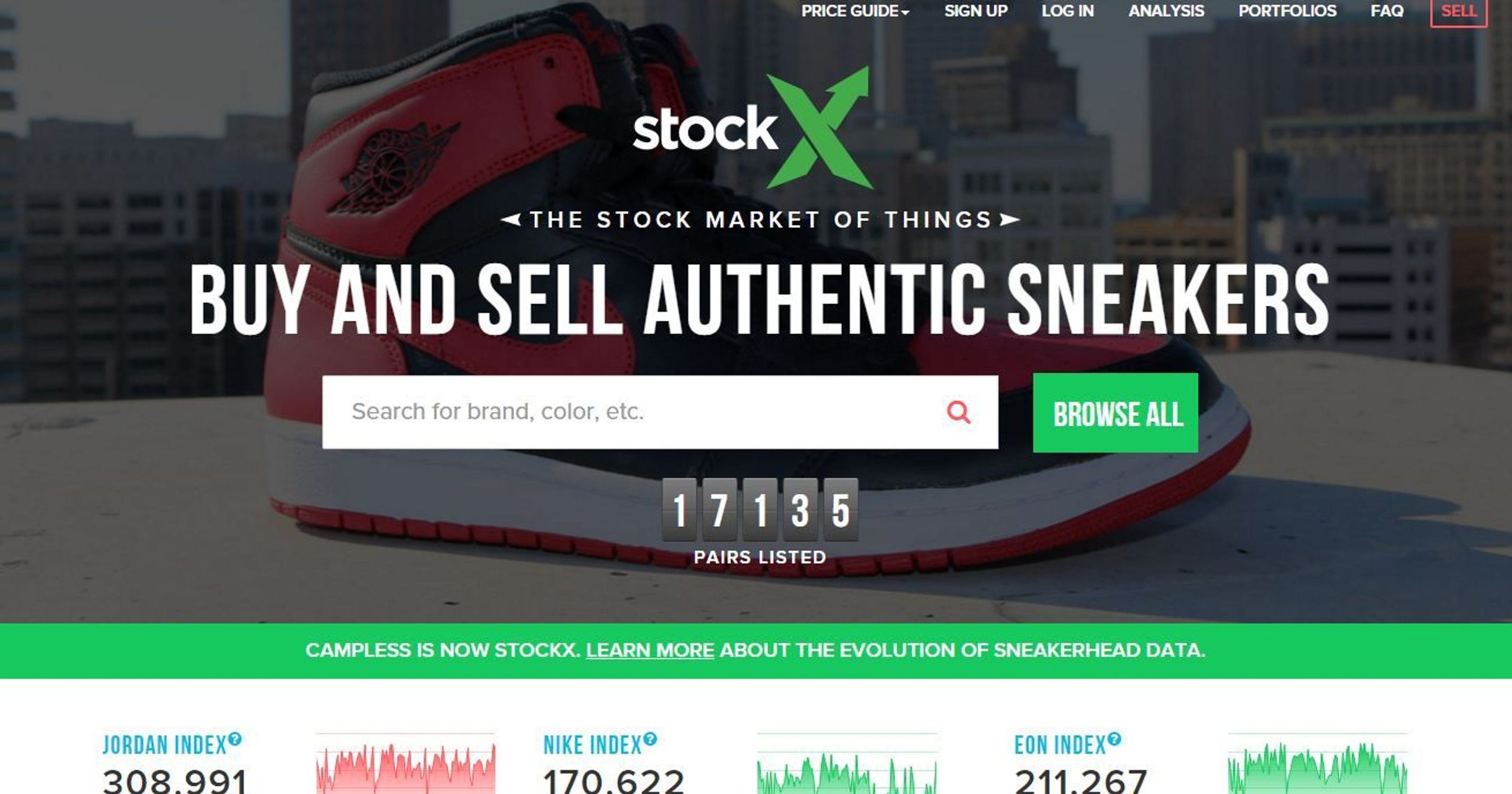

StockX is a market place for things. Things including primarily sneakers, watches and street wear. StockX is where I look first to find what the resell value for a pair of sneakers or street wear is currently. As an avid sneaker enthusiast and finance guy, I jumped at an opportunity to enter StockX’s second data contest (first one was in 2017). For the contest, we were given an excel file with sneaker resell data which consisted of a random sample of all Off-White x Nike and Yeezy 350 sales in the US from 9/1/2017 - 2/15/2019. There are 99,956 total sales in the data set; 27,794 Off-White sales, and 72,162 Yeezy sales. Link to the excel file.

After initially parsing over the data, two main questions/hypothesis surfaced: 1) Does the shoe color (lighter vs darker) suit different regions better (colder climates like darker shoes, warmer climates like brighter shoes) and 2) When is the best time to resell sneakers?

Part 1: Yeezy Sales and Region

Hypothesis: Warmer regions sell more warmer colored Yeezys (Starting from top left: Zebra, Cream, Butter, Sesame, Static) while colder regions sell more cooler colored Yeeyzs (Core Black: green, red and copper).

In order to test our hypothesis, we compared Yeezy Sales in NYC versus Cali. Here’s what we found:

Comparing New York and California is interesting as well (California’s average sales 1965 pairs and New York’s average sales is 1724 pairs). The Butter, Zebra, and Sesame Yeezys sold better (relatively) in New York, where as the Cream, Static and Core Black Yeezys did better in California. The largest difference is in the sales of the Core Blacks where California sold 2655 pairs and New York only sold 1899 pairs. California has a population of 38M where as New York's is 19M. However, New York is more "walkable" where as most of California drives. It appears that Yeezy color has no effect.

These three states have relatively lower income in the US. We can see that the most exclusive and expensive shoes (Core Black) sold significantly less in these three states than any other Yeezy.

Here we have three states with relatively higher average income in the US. We can see that the Core Black sales are significantly higher than these other Yeezys.

Part 2: Optimal Resell Timing

Off-White Collection by Virgil Abloh and Nike’s “The Ten” collaboration release from late October to early November in 2017. The first releases were split into two packs of five. The “REVEALING” pack included the Nike Air Jordan 1, Air Max 90, Air Presto, Air VaporMax, and Blazer Mid. The “GHOSTING” pack included the Nike Air Max 97, React Hyperdunk, Air Force 1, Zoom Vaporfly, and Converse Chuck Taylor All Star shown in order below.

Using tableau, we can see the average profit through the weeks after release as measure dimensions (continuous) and the buyer region as the filter rows. However, we want to further drill down to take a closer look at a few key states.

Here is a cleaner look and visual of the average premiums paid for shoes in four key locations: New York (n=16,525), California (n=19,349), Oregon (n=7,681) and my home state Illinois (n=43,345). The green zones are the most profitable while the red zones are the least profitable. Ultimately we can confirm our hypothesis with a high prior to release with a drop off then recovery over time. However, the drop off between week 70-105 was unexpected.

Ultimately, I learned so much from this project and although I didn’t win the challenge, I want to thank StockX for giving me their resell data to dissect. I am very curious about what trends and stories YOU can find from the data. Feel free to send me a message via Instagram or LinkedIn with your suggestions or if you want to see my excel file!